Fintech mobile apps are revolutionizing how people interact with finance. From seamless payments to streamlined investments, these apps are transforming the financial landscape, making it more accessible and convenient. This exploration delves into the evolution, features, security, and future trends of fintech mobile apps, offering a comprehensive understanding of their impact on both users and the broader financial ecosystem.

The Artikel covers various aspects of fintech mobile apps, including user experience, security measures, development trends, customer engagement, business models, financial inclusion, regulatory considerations, competitive analysis, and future prospects. Detailed case studies of successful apps are also included to highlight practical applications and lessons learned.

Introduction to Fintech Mobile Apps

Fintech mobile apps have rapidly transformed how individuals and businesses interact with financial services. These applications leverage technology to streamline transactions, access investment opportunities, and manage finances on-the-go. This accessibility and ease of use have been pivotal in the widespread adoption of these tools.

Definition of Fintech Mobile Apps

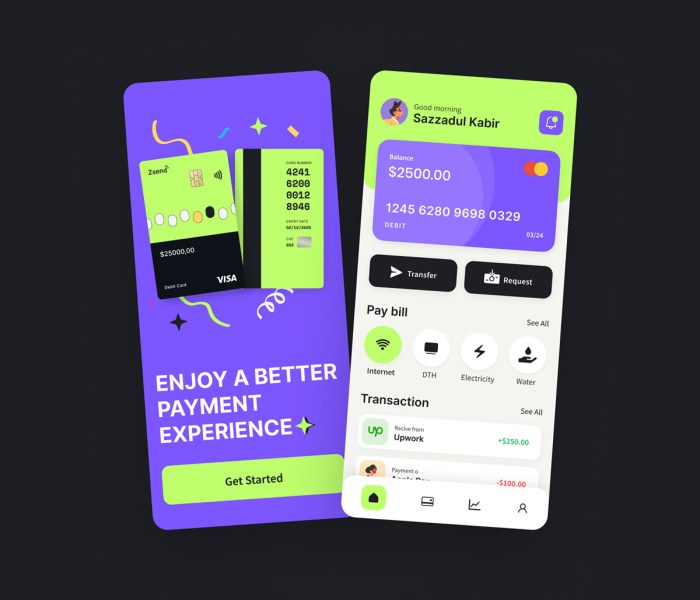

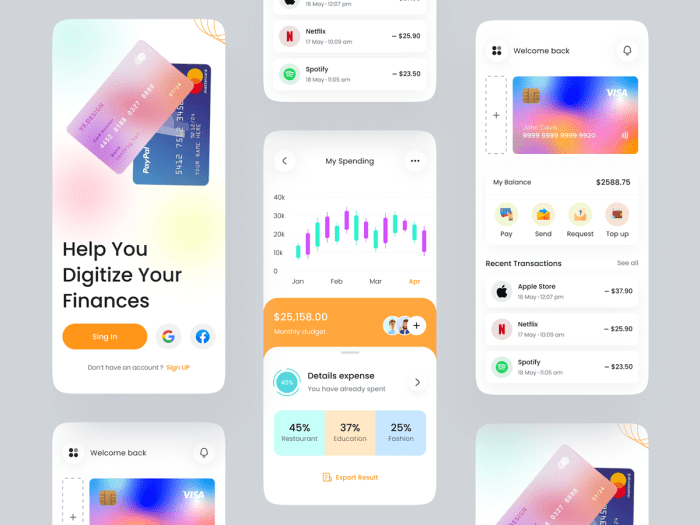

Fintech mobile apps are software applications designed for mobile devices that provide financial services and functionalities. These apps offer users a convenient platform to perform a range of financial tasks, from making payments and managing accounts to investing and borrowing money. They are characterized by their user-friendly interfaces and access to real-time data.

Evolution and Growth of Fintech Mobile Apps

The rise of fintech mobile apps has been fueled by advancements in mobile technology, internet connectivity, and increasing consumer demand for convenient and accessible financial solutions. Initially focused on simple payment processing, these apps have expanded to encompass a broader spectrum of financial services, including investments, lending, and wealth management. The growing availability of smartphones and reliable internet access has played a critical role in their explosive growth.

The market is highly competitive, with numerous players offering specialized and comprehensive services.

Key Features and Functionalities

Fintech mobile apps typically feature user-friendly interfaces, enabling seamless navigation and access to crucial information. Real-time data updates are essential for keeping users informed about their accounts and transactions. Security features, such as two-factor authentication and encryption, are paramount to protecting sensitive financial information. These apps often offer push notifications, alerts, and personalized insights to enhance user experience and engagement.

Categories of Fintech Mobile Apps

The diverse range of fintech mobile apps can be categorized based on the specific financial services they offer. The table below provides a concise overview of different categories and examples:

| Category | Description | Examples |

|---|---|---|

| Payments | Facilitating digital payments, peer-to-peer transfers, and mobile wallets. | PayPal, Venmo, Alipay, Google Pay |

| Investing | Providing access to investment products, including stocks, bonds, and cryptocurrencies. | Robinhood, Fidelity Go, eToro |

| Lending | Offering personal loans, peer-to-peer lending, and other credit services. | LendingClub, Prosper, Upstart |

| Banking | Providing core banking functionalities like account management, transactions, and bill payments. | Chase Mobile, Bank of America Mobile, Citi Mobile |

| Insurance | Simplifying insurance purchasing, claims management, and policy administration. | Progressive, State Farm, Geico mobile apps |

Security and Privacy in Fintech Mobile Apps

Fintech mobile applications have become indispensable tools for managing finances. However, the sensitive nature of financial data necessitates robust security measures to protect users from fraud and data breaches. This section delves into the crucial aspects of security and privacy within these apps.The security of user data is paramount in fintech mobile applications. Compromised accounts can lead to significant financial losses and reputational damage for both users and the companies providing the apps.

Implementing and maintaining effective security protocols is essential to fostering user trust and confidence.

Importance of Security in Fintech Mobile Apps

Protecting user financial information is critical. Security breaches can result in significant financial losses and damage user trust. Robust security measures are necessary to deter malicious actors and ensure the integrity of user data. This includes preventing unauthorized access, protecting against data breaches, and maintaining data confidentiality.

Security Measures in Fintech Mobile Apps

Several security measures are employed in fintech mobile applications to safeguard user data. These include encryption, multi-factor authentication (MFA), and regular security audits.

- Encryption: Data encryption transforms sensitive information into an unreadable format, making it virtually impossible for unauthorized individuals to access. This process is crucial for protecting user credentials, transaction details, and personal information. For instance, end-to-end encryption ensures that only the sender and recipient can access the data, protecting it from potential intermediaries.

- Multi-Factor Authentication (MFA): This security protocol requires users to provide multiple forms of verification before accessing their accounts. This could involve entering a password, receiving a code via SMS or email, or utilizing biometric authentication methods like fingerprint or facial recognition. Implementing MFA significantly reduces the risk of unauthorized access. For example, a user might need to enter a password, then confirm the login with a code sent to their mobile phone.

- Regular Security Audits: Regular assessments of the app’s security protocols help identify vulnerabilities and ensure compliance with industry best practices. This proactive approach mitigates potential threats and strengthens the overall security posture of the application.

Privacy Concerns Related to Fintech Mobile Apps

User privacy is a significant concern in fintech mobile apps. The collection and use of personal data raise questions about data security and user control. Transparency about data usage and user rights is crucial.

- Data Collection and Usage: Fintech apps often collect extensive personal data, including financial information, transaction history, and location data. Clear and concise policies on data collection and usage must be readily available to users.

- Data Security: Robust security measures are vital to protect user data from unauthorized access or breaches. Implementing encryption, MFA, and secure storage solutions are necessary.

- User Control: Users should have clear control over their data. This includes the ability to access, modify, and delete their personal information. Transparency regarding data sharing practices is also important.

Demonstration of Security Protocols, Fintech mobile apps

Fintech applications utilize various security protocols to safeguard user data. Examples include Transport Layer Security (TLS) for secure communication and secure storage solutions for sensitive data.

- Transport Layer Security (TLS): TLS encrypts communication between the user’s device and the fintech application’s server. This prevents unauthorized interception of sensitive data during transmission.

- Secure Storage Solutions: Databases and servers storing user data utilize robust encryption and access controls. These measures limit unauthorized access to data.

Comparison of Security Features in Fintech Apps

The table below provides a comparative overview of security features across different fintech applications. This highlights the varying levels of security implemented by different companies.

| Fintech App | Encryption | Multi-Factor Authentication | Data Breach Detection |

|---|---|---|---|

| App A | End-to-end encryption | SMS-based MFA | Real-time monitoring |

| App B | TLS encryption | Biometric MFA | Regular audits |

| App C | Data-at-rest encryption | Email-based MFA | Automated alerts |

Fintech Mobile App Development Trends: Fintech Mobile Apps

The fintech landscape is rapidly evolving, driven by technological advancements and user expectations. Mobile apps are at the forefront of this transformation, enabling seamless financial transactions and innovative services. This evolution necessitates a keen understanding of emerging trends to ensure effective development and user experience.Modern fintech mobile apps are no longer limited to basic banking functions. They integrate cutting-edge technologies, catering to a diverse range of user needs and preferences.

This evolution demands developers to stay abreast of current and emerging trends to create user-friendly and secure applications.

Fintech mobile apps are booming, and their success hinges heavily on robust mobile app development. This crucial aspect of creating user-friendly and secure apps often involves complex processes, which are a key part of the whole fintech mobile app experience. A solid foundation in mobile app development is essential for crafting engaging and functional fintech apps that meet the evolving needs of today’s users.

The increasing complexity of these financial tools necessitates a strong grasp of this field.

Emerging Technologies Shaping Fintech Mobile Apps

The integration of innovative technologies is transforming the fintech mobile app landscape. Blockchain technology, artificial intelligence (AI), and machine learning (ML) are reshaping how financial services are delivered. Blockchain’s potential for secure and transparent transactions is increasingly relevant in fintech, particularly for cryptocurrencies and peer-to-peer payments. AI and ML algorithms enhance user experience by personalizing financial advice, fraud detection, and risk assessment.

Impact of Mobile-First Strategies

A mobile-first approach is crucial in the fintech industry. Fintech companies are prioritizing the mobile experience, recognizing the significant portion of users who interact with financial services primarily through their mobile devices. This strategy drives faster onboarding, personalized financial management tools, and improved accessibility, leading to enhanced user engagement. Mobile-first development ensures applications are optimized for various screen sizes and device functionalities, resulting in a consistent and user-friendly experience across different platforms.

Integration with Other Technologies

Fintech apps are increasingly integrating with other technologies, expanding their functionality and capabilities. Wearable devices like smartwatches and fitness trackers are integrating with fintech apps to provide users with personalized financial insights, allowing users to track spending habits and automate payments. Smart devices are also being used to improve security and reduce friction in the user experience. For example, biometric authentication through fingerprint scanners and facial recognition is becoming commonplace in fintech apps, enhancing security and convenience.

Mobile App Accessibility for Different User Groups

Ensuring accessibility for diverse user groups is paramount in fintech app development. This includes users with disabilities, who require accommodations such as screen readers and alternative input methods. Accessible design principles are essential to cater to the needs of a wider audience and avoid excluding potential users. Mobile apps should be developed with universal design principles in mind, ensuring that users with varying abilities can navigate and utilize the application effectively.

Fintech App Development Platforms

| Platform | Description | Pros | Cons |

|---|---|---|---|

| React Native | A JavaScript framework that allows developers to build native mobile apps for iOS and Android using a single codebase. | Faster development, cost-effective, reusable code. | Performance might be slightly lower compared to native development. |

| Flutter | An open-source framework from Google that uses Dart as its programming language to create native mobile apps. | Excellent performance, cross-platform compatibility, rich set of UI widgets. | Smaller developer community compared to React Native. |

| Ionic | A framework based on web technologies (HTML, CSS, JavaScript) that enables developers to create hybrid mobile apps. | Easy to learn and get started with, faster development compared to native development. | Performance can be less optimal compared to native apps. |

| Native Development (Swift/Kotlin) | Building apps specifically for iOS (Swift) or Android (Kotlin). | Best performance, full control over the device’s features. | Longer development time, higher development costs. |

This table highlights the various development platforms employed for creating fintech applications, showcasing the diverse approaches used to achieve cross-platform compatibility and performance.

Customer Engagement and Retention

Attracting and retaining customers in the competitive fintech landscape is crucial for long-term success. Effective engagement strategies go beyond simply providing a functional app; they involve understanding user needs and tailoring the experience to foster loyalty and advocacy. This section delves into key strategies for achieving this.

Strategies for Engaging Users

A well-designed user interface (UI) and user experience (UX) are fundamental to initial user engagement. Intuitive navigation, clear information architecture, and aesthetically pleasing design elements contribute significantly to a positive first impression. Beyond the initial interaction, frequent, relevant communication and proactive support are critical for maintaining user engagement.

Methods for Increasing User Engagement and Retention

Several methods can be employed to increase user engagement and retention. These include offering personalized recommendations tailored to individual user needs and behaviors, implementing gamification elements to encourage active participation, and providing exclusive rewards and benefits to loyal customers. Interactive features such as quizzes, polls, and contests can also increase engagement.

Examples of Effective Customer Service in Fintech Mobile Apps

Effective customer service is crucial for retention. This includes readily accessible and responsive customer support channels, such as live chat, email, and phone support. Apps that allow users to easily submit feedback and report issues contribute to positive user experiences. Proactive support, such as automated notifications for account updates or scheduled maintenance, can also enhance customer satisfaction.

Prompt and helpful responses to user inquiries and concerns, along with personalized support tailored to individual user needs, can greatly impact user satisfaction.

The Role of Personalization in Enhancing User Experience

Personalization is paramount in enhancing user experience within fintech apps. Analyzing user data, such as transaction history, investment preferences, and spending patterns, allows for the delivery of customized product recommendations, tailored financial advice, and personalized offers. By catering to individual user needs and preferences, fintech apps can foster a stronger sense of connection and loyalty. This targeted approach can significantly improve user satisfaction and encourage continued use.

Strategies to Increase Customer Loyalty

Building customer loyalty requires a multifaceted approach. Offering exclusive rewards and incentives, such as discounts, cashback, or early access to new features, is essential. Personalized onboarding sequences and regular engagement through email newsletters and in-app notifications can reinforce customer relationships. Recognizing and rewarding loyal users with special status or exclusive privileges can also encourage repeat use and advocacy.

Additionally, collecting and analyzing user feedback to continuously improve the app and address user concerns can foster a strong sense of community and encourage customer loyalty.

Business Models and Monetization

Fintech mobile apps are increasingly diverse in their approaches to revenue generation. Understanding the various business models and monetization strategies is crucial for app development and success in this competitive market. Different categories of fintech apps require tailored strategies to attract and retain users while maximizing profitability.Successful fintech apps often leverage a combination of monetization techniques, adapting to the specific needs and value proposition of their target audience.

This approach allows for a sustainable and scalable revenue model that caters to the unique demands of the digital financial landscape.

Different Business Models for Fintech Apps

Various business models cater to different fintech app functionalities and target users. A key distinction lies in the core value proposition offered to customers. Some apps focus on facilitating transactions, others on providing financial advice or investment tools.

- Transaction-focused apps: These apps aim to streamline and improve financial transactions, often through features like peer-to-peer (P2P) payments, money transfers, or bill payments. The revenue model often relies on transaction fees or partnerships with payment processors.

- Investment platforms: These platforms facilitate access to investment products, ranging from brokerage services to robo-advisors. Monetization strategies typically include commission on trades, subscription fees for premium features, or a combination of both.

- Financial management tools: These apps help users manage their finances, providing budgeting, expense tracking, and savings tools. Revenue models may include subscriptions for advanced features, or partnerships with financial institutions for exclusive services.

- Lending platforms: These apps connect borrowers with lenders. Monetization can come from fees charged to borrowers, or interest earned on loans.

Monetization Strategies

Effective monetization strategies are essential for fintech app success. The chosen approach depends on the app’s features, target audience, and overall value proposition.

- Subscription models: Providing premium features or functionalities to users in exchange for a recurring fee is a common monetization strategy. Tiered subscriptions with varying levels of access can cater to different user needs and budgets. For instance, a budgeting app could offer a free tier with basic features, a premium tier with advanced tracking tools, and a business tier for more detailed insights.

- Transaction fees: Many fintech apps earn revenue through transaction fees. This can be for each transaction or a percentage of the transaction amount. This model is common in payment processing apps or platforms facilitating peer-to-peer transactions.

- Commission models: Apps that facilitate transactions or services like loans or investment trades can earn commissions on the completion of a transaction. This model is prevalent in brokerage services, insurance comparison platforms, or marketplaces.

- Partnerships: Strategic partnerships with other financial institutions, payment processors, or third-party services can be a key revenue stream. This allows access to wider user bases and potentially more customers. These partnerships can also provide the app with access to resources, expertise, and data.

Role of Partnerships in Fintech App Monetization

Strategic alliances are vital for fintech app success. Partnerships can broaden reach, enhance functionality, and diversify revenue streams.

- Expanding Market Reach: Partnerships can expose the app to a larger customer base, thus boosting user acquisition and retention. This is especially true for apps that depend on partnerships with established financial institutions.

- Access to Resources and Expertise: Partnerships can provide fintech apps with access to valuable resources, expertise, and technology. This collaboration can enhance app functionality and efficiency.

- Enhanced User Experience: Seamless integration with partner services can significantly enhance the user experience and create a more appealing platform.

Challenges of User Acquisition and Retention in Fintech

The fintech space presents unique challenges in user acquisition and retention. Building trust and demonstrating value are crucial factors in achieving success.

- Building Trust: Users are hesitant to share sensitive financial information with unfamiliar apps. Building trust through transparency, secure practices, and positive user reviews is paramount. This requires meticulous attention to security and data privacy practices.

- Competition: The fintech market is highly competitive. Apps need to differentiate themselves through innovative features, excellent customer service, and a strong value proposition.

- Regulatory Compliance: Navigating complex financial regulations and adhering to compliance standards is crucial to avoid legal issues and maintain user trust. This often requires significant investment in compliance infrastructure and personnel.

Revenue Models for Different Fintech App Categories

The specific revenue model varies depending on the fintech app category. The app’s focus and functionality drive the chosen monetization strategy.

| App Category | Potential Revenue Models |

|---|---|

| Transaction-focused apps | Transaction fees, partnerships with payment processors |

| Investment platforms | Commission on trades, subscription fees, robo-advisor fees |

| Financial management tools | Subscription fees, partnerships with financial institutions, premium features |

| Lending platforms | Fees charged to borrowers, interest earned on loans |

Fintech Mobile Apps and Financial Inclusion

Fintech mobile apps are increasingly playing a pivotal role in bridging the financial inclusion gap, particularly for underserved populations. These apps provide access to financial services that were previously unavailable or inaccessible due to geographical limitations, lack of infrastructure, or other barriers. This access fosters economic empowerment and can lead to significant improvements in living standards for individuals and communities.Fintech apps are revolutionizing financial services by removing traditional barriers and promoting greater accessibility.

They are designed to empower individuals with limited or no access to formal financial institutions, offering a wide range of services from savings accounts and remittances to micro-loans and bill payments. This expanded access fosters economic growth and stability, ultimately contributing to a more inclusive financial system.

Role in Promoting Financial Inclusion

Fintech mobile apps democratize financial services by eliminating geographical and infrastructure constraints. They allow individuals in remote areas or those without traditional bank accounts to participate in the formal financial system. This accessibility empowers them to manage their finances, save for the future, and access credit, fostering economic independence and stability.

Impact on Underserved Communities

Fintech apps have a profound impact on underserved communities, particularly in developing nations. These apps often address specific needs and challenges, offering solutions that traditional financial institutions may not provide. This tailored approach helps address financial literacy gaps and empowers individuals to make informed financial decisions, leading to long-term positive economic outcomes.

Addressing Financial Literacy Gaps

Many fintech apps incorporate features designed to improve financial literacy. Interactive tutorials, educational resources, and personalized financial advice are often embedded within the app experience. This approach fosters a better understanding of financial concepts, such as budgeting, saving, and investing, and empowers users to make sound financial decisions. By simplifying complex financial information, these apps help close the gap in financial literacy, ultimately promoting financial empowerment.

Examples of Fintech Apps for Underserved Communities

Several fintech apps have been specifically designed to meet the needs of underserved communities. These apps often feature simplified interfaces, multilingual support, and local payment options. For instance, some apps offer tailored savings plans, accessible micro-loans, or streamlined remittance services, designed to meet the unique financial requirements of particular regions or demographic groups.

Facilitating Micro-Financing

Fintech apps are particularly effective in facilitating micro-financing. They provide a platform for connecting individuals with micro-loan providers, enabling access to small amounts of capital for entrepreneurship or essential needs. These apps streamline the loan application process, reduce administrative burdens, and enable faster disbursement of funds, promoting entrepreneurship and economic growth.

Regulatory Landscape for Fintech Mobile Apps

The fintech mobile app industry is rapidly evolving, necessitating a robust regulatory framework to protect users and maintain financial stability. This framework ensures responsible innovation and fair competition within the sector. Understanding the regulatory landscape is crucial for developers, operators, and investors to navigate the complexities of compliance and market entry.The regulatory landscape for fintech mobile apps is intricate and dynamic, varying significantly across jurisdictions.

Compliance requirements are tailored to specific financial services offered, user data protection, and the overall risk profile of the app. This necessitates a thorough understanding of the local regulations to avoid legal issues and maintain operational efficiency.

Key Regulations Governing Fintech Mobile Apps

The regulatory landscape for fintech mobile apps is complex, with a multitude of laws and regulations governing various aspects of their operation. These regulations encompass user data protection, financial services offered, and consumer protection. For example, payment processing apps must comply with anti-money laundering (AML) and know-your-customer (KYC) regulations. Similarly, lending apps must adhere to specific lending regulations.

Compliance Requirements for Different Jurisdictions

Compliance requirements vary significantly across jurisdictions. For instance, the European Union’s General Data Protection Regulation (GDPR) imposes stringent data protection standards for apps operating in the EU. In contrast, regulations in the United States are often more fragmented, with different states and federal agencies having jurisdiction over various financial services. This necessitates a tailored approach to compliance based on the specific geographical markets.

Challenges of Navigating the Regulatory Landscape

Several challenges arise when navigating the regulatory landscape for fintech mobile apps. The sheer volume of regulations can be overwhelming, and the ever-changing nature of these regulations requires continuous monitoring and adaptation. Different jurisdictions may have differing interpretations of the same regulations, creating uncertainty and potential legal issues. Ensuring compliance across various jurisdictions presents significant logistical and financial challenges.

The constant updates and revisions to regulations also pose a considerable challenge for maintaining compliance.

Impact of Regulatory Changes on Fintech App Development

Regulatory changes have a direct impact on fintech app development. Developers need to incorporate compliance features into their apps, potentially adding complexity and development costs. These changes can influence the design and functionality of the apps, requiring modifications to address regulatory mandates. For example, the introduction of new KYC/AML regulations may necessitate the implementation of advanced identity verification systems within the app.

Importance of Compliance in the Fintech Industry

Compliance is paramount in the fintech industry. It fosters trust among users, builds a strong reputation for the app and its company, and helps avoid costly legal issues. By adhering to regulations, fintech companies demonstrate a commitment to responsible business practices, which ultimately contributes to the overall stability and growth of the financial sector. Moreover, robust compliance programs protect users from potential harm and contribute to the industry’s reputation for trustworthiness.

Competitive Analysis of Fintech Mobile Apps

The fintech mobile app market is highly competitive, with numerous players vying for market share. Understanding the strengths and weaknesses of competitors, along with their pricing strategies and market positioning, is crucial for any fintech startup or established player seeking to succeed. This analysis will explore the competitive landscape in key fintech segments, highlighting key competitors and their respective advantages and disadvantages.

Key Competitors and Their Strengths and Weaknesses

Several prominent fintech mobile apps have established a strong presence in the market. Comparing these apps allows for an understanding of the competitive landscape. A significant factor in success is identifying specific strengths and weaknesses of each app, which can be leveraged to create a competitive advantage.

- PayPal: PayPal’s strength lies in its established global network and extensive payment processing infrastructure. However, its mobile app might lack the innovative features seen in newer competitors, potentially limiting its appeal to younger demographics. Their user base is vast, offering significant advantages in terms of transaction volume and customer reach.

- Venmo: Venmo excels in peer-to-peer (P2P) payments, fostering a strong social aspect in its transactions. This strength is often a major draw for younger users. However, its focus on P2P payments might limit its appeal to businesses and those requiring more complex financial solutions.

- Cash App: Cash App has effectively leveraged its mobile-first approach, offering a streamlined user experience and user-friendly interface. The app also facilitates investment opportunities, expanding its appeal beyond simple payment services. Its focus on ease of use and a user-friendly interface is a significant advantage, attracting a broader user base.

- Chime: Chime differentiates itself by providing free checking and savings accounts with minimal or no monthly fees. This competitive advantage targets consumers seeking low-cost banking options. However, Chime’s limited financial product offerings compared to traditional banks could be a constraint for users needing more extensive financial services.

Competitive Landscape in Different Fintech Segments

The fintech landscape is segmented into various categories, each with its own unique competitive dynamics. Analyzing these segments helps to understand how various players compete within the market.

- P2P Payments: Venmo, Cash App, and Zelle dominate this segment. Their competitive advantage stems from the integration of social elements, fostering a user-friendly and transparent transaction experience.

- Mobile Banking: Chime and other neobanks offer a competitive alternative to traditional banks by focusing on a mobile-first approach and eliminating many unnecessary fees. This approach appeals to cost-conscious consumers.

- Investment Platforms: Robinhood and other platforms have simplified the process of investing, particularly for younger demographics. Their focus on accessibility and user-friendliness has created a strong presence in this market segment.

Pricing Strategies of Leading Fintech Apps

The pricing strategies employed by fintech apps vary significantly, reflecting their unique value propositions and target markets. Analyzing these strategies is essential to understanding how competitors position themselves within the market.

- Free-to-Use Models: Many P2P payment apps and neobanks operate on a free-to-use model, often generating revenue through transaction fees or partnerships with third-party providers. This strategy attracts a large user base by offering a low barrier to entry.

- Subscription-Based Models: Some apps offer premium features or enhanced services for a monthly subscription fee. This approach allows for more targeted revenue generation, though it requires users to commit to a recurring payment.

- Transaction Fee Models: Apps may charge a small fee for each transaction, which allows for a steady stream of revenue based on the volume of transactions. This strategy is prevalent in payment processing apps.

Features and Functionalities Comparison

A comparative analysis of features and functionalities is critical to understanding the distinct offerings of different fintech apps.

| App | Key Features | Functionality Highlights |

|---|---|---|

| PayPal | Global payment processing, cross-border transactions | Secure and reliable platform for diverse transactions |

| Venmo | P2P payments, social sharing | User-friendly interface for quick peer-to-peer transfers |

| Cash App | P2P payments, investment options | Versatile platform encompassing payments and investments |

| Chime | Free checking and savings accounts | Cost-effective banking options for budget-conscious users |

Future Outlook of Fintech Mobile Apps

The fintech mobile app landscape is dynamic and rapidly evolving. Predictions for future growth hinge on the seamless integration of emerging technologies, the ability to address user needs effectively, and the successful navigation of regulatory complexities. Innovation in this sector will drive both significant opportunities and potential challenges.

Predicted Trends and Developments

The future of fintech mobile apps will be characterized by an increased emphasis on personalized experiences, leveraging artificial intelligence for enhanced functionalities, and integrating blockchain technology for enhanced security and transparency. Expect to see more sophisticated mobile payment systems, sophisticated investment platforms, and the rise of robo-advisors. These developments will streamline financial transactions, empower users with greater control, and democratize access to financial services.

Potential Challenges and Opportunities for Future Growth

The fintech mobile app industry faces challenges such as maintaining user trust, addressing regulatory compliance issues, and staying ahead of evolving cybersecurity threats. Opportunities exist in developing innovative solutions for niche markets, such as small businesses or underserved populations, and creating inclusive financial platforms that address the needs of diverse user groups. Addressing these challenges and seizing these opportunities will be critical for continued success.

Impact of Emerging Technologies

Emerging technologies like artificial intelligence (AI), machine learning (ML), and blockchain are poised to significantly impact fintech mobile app development. AI-powered chatbots can provide personalized customer service, while ML algorithms can analyze user data to offer tailored financial advice and investment strategies. Blockchain technology can enhance security, transparency, and efficiency in transactions. These advancements will drive innovation and enhance the user experience.

Role of Artificial Intelligence in Fintech App Development

Artificial intelligence is transforming fintech mobile app development by automating tasks, personalizing user experiences, and improving decision-making. AI-powered chatbots can answer customer queries, provide personalized financial advice, and assist with transactions. AI algorithms can analyze user data to identify fraud and improve security measures. AI’s role will continue to expand in offering intelligent insights and solutions within fintech applications.

Key Trends in Fintech App Development

| Trend | Description | Example |

|---|---|---|

| Increased Personalization | Apps will offer highly tailored experiences based on individual user needs and preferences. | Personalized investment recommendations, customized budgeting tools, and tailored financial advice. |

| Enhanced Security and Privacy | Enhanced security measures, like biometric authentication and multi-factor authentication, will become standard. | Biometric logins, encryption of sensitive data, and robust two-factor authentication systems. |

| Integration of Emerging Technologies | Apps will incorporate AI, ML, and blockchain to enhance functionality and security. | AI-powered chatbots for customer support, ML-driven fraud detection, and blockchain-based secure transactions. |

| Focus on User Experience (UX) | Apps will prioritize intuitive design and seamless navigation for a better user experience. | Clear and concise interfaces, interactive elements, and personalized user dashboards. |

| Expansion into Niche Markets | Fintech apps will cater to underserved populations and specific needs. | Mobile banking solutions for unbanked populations, specialized investment platforms for small businesses, and digital payment solutions for specific industries. |

Case Studies of Successful Fintech Mobile Apps

A multitude of fintech mobile apps have emerged, and many have achieved significant success. Examining these successful ventures reveals key factors that propelled their growth and provides valuable lessons for aspiring developers and entrepreneurs. These case studies highlight the critical interplay between innovative features, user-centric design, and market responsiveness in shaping a successful fintech app.

Key Success Factors of Fintech Mobile Apps

Understanding the core elements that contribute to the success of fintech mobile apps is crucial. A range of factors influence their trajectory, from user experience to market positioning. These factors are essential for building a robust and user-friendly app that resonates with the target market.

- User-Centric Design: Successful apps prioritize the user experience. Intuitive interfaces, clear navigation, and streamlined workflows are vital. For example, Monzo’s app design is praised for its simplicity and ease of use, enabling users to effortlessly manage their finances. This focus on user-friendliness ensures a positive experience, encouraging engagement and retention.

- Innovative Features: Differentiation is key in the competitive fintech landscape. Novel features, like embedded payments, automated budgeting, or personalized financial advice, set successful apps apart. Apps like Chime, with its focus on peer-to-peer payments and savings features, showcase how innovative features can attract a significant user base.

- Strong Security and Privacy: In the financial sector, security is paramount. Successful fintech apps implement robust security measures, complying with stringent regulations and providing users with peace of mind. A secure and trustworthy environment is essential to foster user confidence and promote adoption.

- Effective Marketing and Branding: Successful apps employ targeted marketing strategies that resonate with their intended audience. Clear value propositions and compelling messaging are crucial in capturing attention and building brand awareness. Apps like Revolut have successfully positioned themselves as global money management solutions through their marketing efforts.

- Continuous Improvement and Adaptation: The fintech landscape is dynamic. Successful apps are adaptable, continuously refining their offerings based on user feedback and market trends. This iterative approach ensures the app remains relevant and user-friendly.

Impact of User Feedback on App Development

User feedback plays a vital role in shaping the evolution of a fintech app. Analyzing user reviews, surveys, and interactions helps identify areas for improvement. This feedback loop allows for adjustments to the app’s design, features, and functionalities to better meet user needs and preferences. This approach directly contributes to a positive user experience.

- Identifying Pain Points: User feedback often reveals pain points in the app’s functionality or design. By understanding these challenges, developers can implement solutions to enhance user satisfaction and efficiency.

- Prioritizing Feature Development: User feedback helps prioritize feature development, focusing on elements that users find most valuable. This approach ensures that the app remains relevant and aligned with user needs.

- Improving User Experience: Collecting and analyzing user feedback allows developers to refine the user experience. Iterative improvements based on user input can lead to a more intuitive and engaging application.

Summary of Key Success Factors

| Factor | Description | Example |

|---|---|---|

| User-Centric Design | Intuitive interface, clear navigation | Monzo |

| Innovative Features | Unique functionalities, embedded payments | Chime |

| Strong Security | Robust security measures, regulatory compliance | PayPal |

| Effective Marketing | Targeted strategies, compelling messaging | Revolut |

| Continuous Improvement | Adaptability based on user feedback | Robinhood |

Closing Notes

In conclusion, fintech mobile apps have dramatically reshaped the financial sector, bringing unprecedented convenience and accessibility. The future looks bright, with ongoing innovation promising even more transformative applications. The discussion highlighted the intricate balance between user experience, security, and business models in driving the success of these applications. As technology advances, fintech apps will continue to play a pivotal role in shaping the financial landscape.

Essential Questionnaire

What are the key security concerns related to fintech mobile apps?

Security is paramount in fintech mobile apps. Concerns include data breaches, unauthorized access, and fraudulent activities. Robust security measures, such as encryption, two-factor authentication, and regular security audits, are crucial to mitigate these risks. User education and awareness about security protocols are also essential for safeguarding user data.

How do fintech apps address financial literacy gaps?

Many fintech apps incorporate educational resources and tools to enhance financial literacy. This includes interactive tutorials, financial calculators, and personalized guidance on budgeting, saving, and investing. Some apps also partner with financial advisors or educational institutions to provide more comprehensive financial support.

What are some emerging technologies shaping the future of fintech mobile apps?

Emerging technologies such as artificial intelligence, machine learning, and blockchain are transforming fintech mobile apps. AI can personalize user experiences, automate tasks, and enhance fraud detection. Blockchain offers increased security and transparency in transactions. These advancements are creating new possibilities for innovative financial solutions.

How can fintech apps increase user engagement and retention?

Fintech apps can boost engagement through personalized recommendations, gamification features, and rewards programs. Offering exclusive deals, timely alerts, and seamless user interactions can further increase user satisfaction and encourage long-term use.